NEW: Global Fintech 2024 Report - Prudence, Profitability and Growth Learn more

Advisory client returns

Diversification that delivers

Our $7+ billion real estate portfolio* is designed to harness the macroeconoDiversifying outside of the public market not only helps in managing risk through non-correlated investments, but also opens up an opportunity for potentially higher returns and strategic investment advantages, thus playing a crucial role in a comprehensive investment strategy.mic drivers of the U.S. real estate market and position our clients for long-term growth.

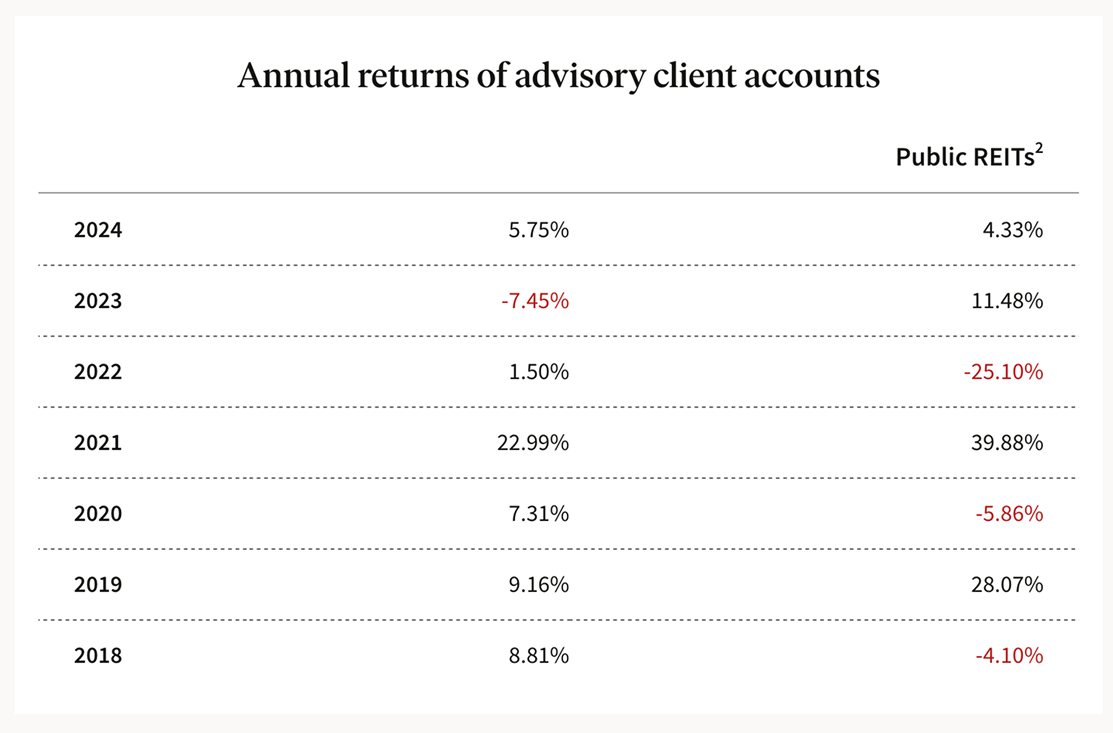

Advisory client performance

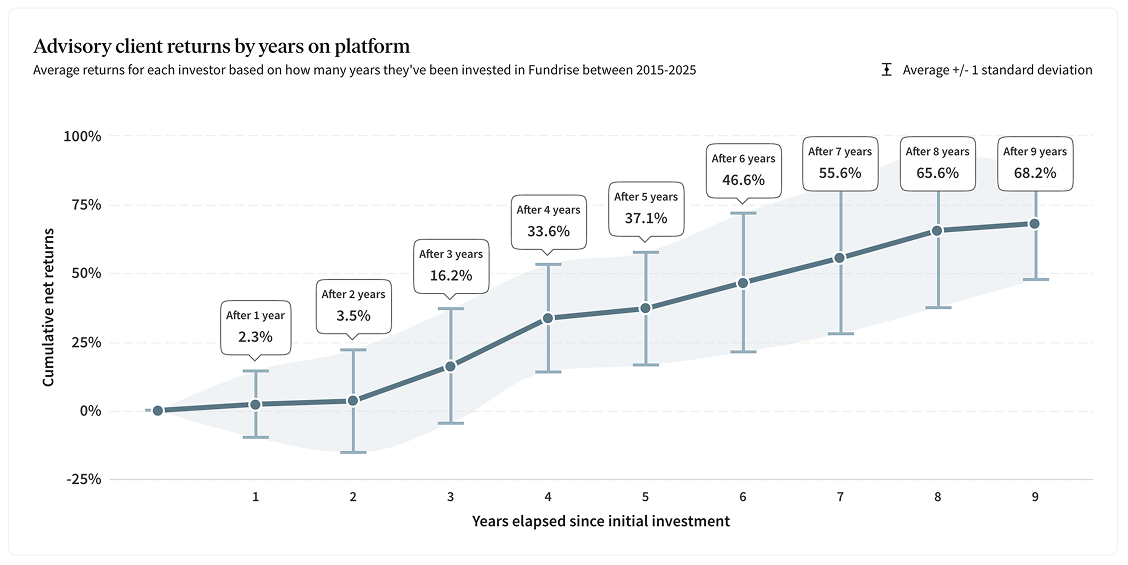

Consistent growth over time

ZED Investors investments are intended to be held long-term, as private investment funds take time to generate value. The data below supports the strategy that time on platform can significantly compound earnings, ultimately yielding the best returns for those who invest with a long-term perspective.

Income through dividends

Real estate allows investors to accrue a unique mix of both long-term appreciation and income potential. The figures here represent the income portion of advisory client returns through our platform and do not include appreciation over time.

Historical stability

How our platform compares to Public REITS

Private real estate has historically shown less volatility compared to public REITs (real estate investment trusts). While public REITs are subject to market and sentiment-driven fluctuations, private real estate has been steady in comparison — exhibiting more smooth and gradual growth overall.