NEW: Global Fintech 2024 Report - Prudence, Profitability and Growth Learn more

Real estate

An opportunistic strategy for income-focused investors

Our $7+ billion real estate portfolio* is designed to harness the macroeconomic drivers of the U.S. real estate market and position our clients for long-term growth.

Why invest in Private real estate

Historically, private market real estate has featured a combination of traits not found in other asset classes: long-term earning potential and effective diversification beyond the stock market.

Wealth preservation and growth

Alternative assets like private real estate have historically offered a unique combination of lower volatility than stocks and higher potential returns than bonds. This mixture can anchor your portfolio, smoothing out the wild ups and downs of the public markets.

Income generation

For many investors, the ability to create consistent income—via equity ownership in apartment buildings or single-family rentals that earn income through rental payments, for instance—is one of the most attractive aspects of real estate investing.

Superior diversification

Private market assets are less likely to be affected by market fluctuations, helping reduce risk and improving your long-term financial stability—even during sustained periods of economic uncertainty.

Build for the future

Our portfolio aims to harness the most powerful long-term macroeconomic drivers of the U.S. economy. Trends like increased demand for well-located residential assets across the sunbelt to the explosion of eCommerce-driven industrial spaces.

Featured fund

Flagship Fund

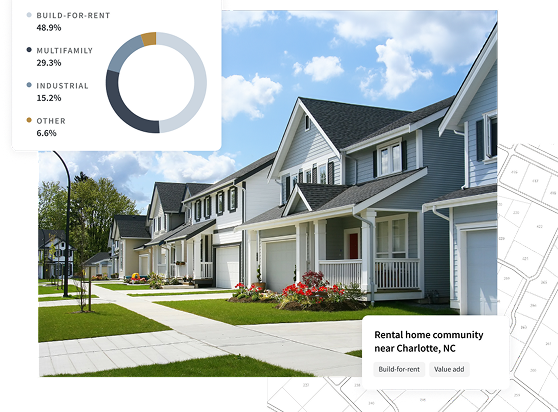

Our Flagship Real Estate Fund is designed to deliver long-term appreciation from a diversified portfolio of our most favored real estate investment strategies: build-for-rent housing communities and multifamily and industrial assets in the Sunbelt.

4.6%

Annualized return since inception

$1.1B

Net asset value (NAV)

0.21%

Annualized distribution rate

Featured fund

Designed to harness the market's potential

By employing a combination of strategies, we aim to build well-rounded, resilient portfolios targeted to deliver consistently strong results based on our clients' goals and appetite for risk.

224

Active projects

231

Completed projects

$7+ billion

Total portfolio value*

Build for rent

A variety of trends have now led to a good share of the population in need of more living space which they can rent for some time. Currently, this demand for single-family rentals (SFRs) has helped drive a level of asset price appreciation uncommon in the world of real estate. By purchasing these homes in volume directly from homebuilders and leasing them up ourselves as stabilized communities, we believe we can get better prices—and returns—than buying the “finished product.”

3,471

Single-family homes

30

U.S. Markets

Multifamily apartments

With a boom in remote work and business-friendly local governments courting employers, more affordably-priced suburban apartment communities have generally experienced stable or growing demand. We’ve paid a lower price for these investments relative to their earnings, and expect a higher income yield in the near term, as well as the potential for greater appreciation over the long term to the extent that demand increases in the future.

8,962

Residential units

10

U.S. Markets

Industrial properties

Propelled by the popularity of e-Commerce, a growing need for logistical facilities and last-mile distribution centers near largely populated areas has made industrial space an attractive long-term investment. Our goal with these investments is to generate a consistent income from commercial tenants, and position ourselves to capture any appreciation in the value of these properties in supply-constrained areas.

2,310,800

Square footage for lease

Explore all projects in our portfolio

Here are the real estate investments that are powering our investors’ returns.

Assets

Dorchester Commerce Center

Summerville, SC

Industrial

Higher Point Commerce Center

Largo, FC

Industrial

Highland Townhomes

North Charleston, SC

Build for rent

Blue Jay Commons

Rincon, GA

Build for rent

215 Interchange

Las Vegas, NV

Industrial

Industrial

Litchfield Park, AZ

Industrial

Montera at Sherrills Ford

Sherrills Ford, NC

Industrial

Asset Backed Securities (ABS) and Bond holdings

Bond/Asset-backed security

Cottonvale Towns

Savannah, GA

Build for rentAdd private real estate to your portfolio

No matter who you are, if you were active in business over the past several years then you were inevitably borrowing to some extent