NEW: Global Fintech 2024 Report - Prudence, Profitability and Growth Learn more

Venture capital

Invest in tomorrow's great tech companies, today

We aim to give all investors the opportunity to invest in a portfolio of top-tier private technology companies before they IPO.

Portfolio Companies

We are actively investing and has built a portfolio that includes some of the top Artificial Intelligence, Machine Learning, and Data Infrastructure companies in the world.

Databricks

Unify your data, analytics and AI

Odoo

Odoo ERP & CRM your business solution for growing company

Canva

Visual Suite for everyone

Service Titan

The better way to run your commercial contracting business

Venta

Your security and compliance verified

Anduril

Transforming defense capabilities with advanced technology

Dbt Labs

Power everything in your business with high quality, trust and reliable data

Ramp

Time is money, save both

Anyscale

Scalable compute for AI and Python

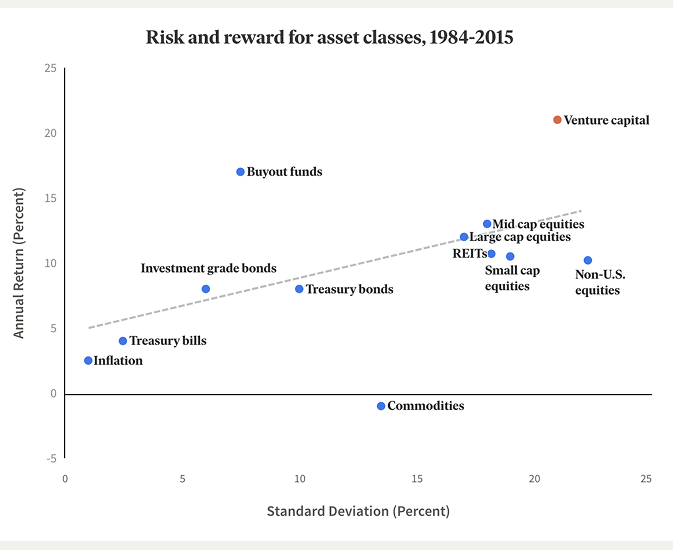

Why venture

Same problem, different asset

Like real estate, the world of investing in private technology companies has remained almost entirely inaccessible to individuals, despite the fact that as an asset class it has proven to be one of (if not the) best performing investment strategies of the past 50 years.

Vast majority of returns accrue in the private markets

With companies staying private longer, the vast majority of the returns from private tech has accrued to the private investors before the public offering. Plus, access is gated, with hefty tolls, by fund managers and growth equity firms, just as in the real estate private equity world.

During the 90's and early 00's, companies like Amazon and Google went public relatively soon in their growth cycle, while companies today are waiting on average 10 years longer. The result: individual investors confined to the public markets are missing out on a substantial portion of the returns generated by the next generation of industry leaders.

About the fund

A growth mindset

We intends to invest in a diversified portfolio largely composed of private high-growth technology companies, with an initial focus on several sectors that we believe have exceptional macro tailwinds.

$110M+

Dollars raised

25K+

Active Investors

Sectors

The difference

Founders and engineers

With growth equity investing, it’s harder to participate in blue-chip private funding rounds than it is to identify the blue-chip companies. However, we believe we have a distinct advantage in the crowded space of venture funding.

Technical expertise

Our decades of first-hand experience building and operating tech companies gives us a deep understanding of the daily challenges and trade-offs a growing company faces. With over 100 software engineers and product managers on staff, we have more software depth and expertise than most venture funds.

Extensive reach

As the largest direct-to-investor alternative asset manager in the country, we offer portfolio companies in-app exposure to nearly 2 million people—many of whom work in technology. Not only can this potentially drive new customers, recruiting, brand recognition, and near-term revenue for our portfolio companies, it can also provide critical name recognition for when it’s time to IPO.

Patient and passive capital

We’ve engineered our investment infrastructure to enable us to be the most patient and passive source of capital on the market, eliminating any incentive to meddle with a founder/CEO’s long-term vision for the sake of our own short-term image or profits.

Our experience can make a difference for you.

$1.2M

Brokerage and advisory client assets, serviced or custodied.

23K+

Financial professionals serviced.

500+

Asset Management and Ventures company

Invest in Innovation

We aim to give all investors the opportunity to invest in a portfolio of top-tier private technology companies before they IPO.